Accountant and CPA Firm Payroll Software

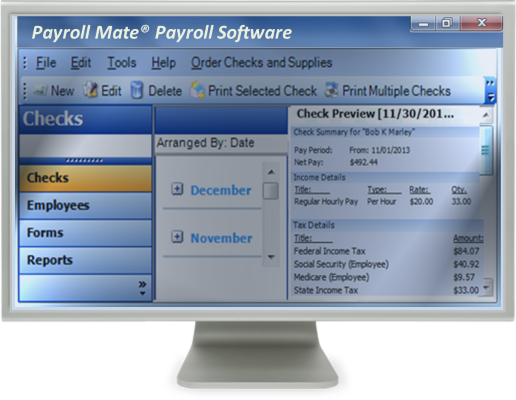

Payroll Mate® makes processing payroll easy and affordable.

Multi-client payroll software for accountants, CPAs and payroll processors with the ability to run on stand-alone desktop computers or shared across the network between multiple users. Run client payroll, print checks, export to QuickBooks, email tax reports and generate W2s / 941s / 940s. Payroll Mate® provides you with the ability to custom create income, tax, and deduction categories. This way you can ensure that you will be able to fulfill all of your client's payroll.

For $219 only, process payroll for up to 10 companies with up to 75 employees per company for one calendar year.

Accountant and CPA Practice Payroll Made Easy

When it comes to processing payroll, accountants and CPAs can have a number of needs. Along with handling payroll for their clients, accountants and CPAs also need to ensure that their own staff is paid on time. Add in the fact that tax season is the busiest time of the year, one can see that accounting professionals are faced with a near Herculean responsibility to ensure that that all records are completed in compliance with governmental requirements.

Payroll Mate® has been specifically designed to help alleviate many of the challenges faced by accounting professionals. Whether you need a payroll software solution for your practice or you need a solution to help you with your clients' payroll, Payroll Mate® can provide you with a host of great features.

Easily Prepare Payroll for Accounting Clients

• Print payroll checks and email the signature ready checks to clients, who can then print the checks quickly and easily.

• Your clients can then print or email pay stubs to their employees for easy access to payroll information.

• Allows for easy communication between accounting professionals and their clients by generating reports and emailing them.

Accurately Calculates Withholdings

• Payroll Mate® works by automatically calculating State and Federal payroll taxes.

• Payroll Mate® is also designed to help you calculate everything from Unemployment, Medicare, Social Security withholdings, and net pay.

Supports Different Types of Pay Frequencies and Pay Types

• As an accounting firm or CPA, you can save time and effort by calculating different payroll frequencies and types for your clients.

• Pay frequencies include daily, weekly, bi-weekly, semi-monthly, and monthly.

• Pay types include hourly, salary, commission, bonuses, and many more.

• Payroll Mate® also allows you to custom create unlimited user-defined income types, as well as tax and deduction categories.

• Vacation and sick time tracking is made easy by Payroll Mate® by a per-check earned basis or a per-year earned basis.

Generating Wage and Tax Statements for Clients

• Payroll Mate® presents your accounting practice with the ability to generate Wage and Tax Statements for your firm as well as for your clients.

• Payroll Mate® is even able to generate 1099 forms if you have clients who employ independent contractors. This is an additional cost add-on feature to Payroll Mate®.

• A variety of tax forms are also included in the standard program such as W-2, W-3, 940, 941, 943, and 944.

Password Protected and Security

• Payroll Mate® helps you to protect your information by giving you the ability to require passwords for authorized users to log onto the system.

• Payroll Mate® is an in-house payroll software. Since this program is not hosted online, you can be reassured that your data is safe and secure.

Ease of Use

• Thanks to the inclusion of a step-by-step wizard and various tutorials, you can have Payroll Mate® up and running in no time.

• Payroll Mate® support is easy to access by phone, email, or live chat.

• You can also rest assured that updates are applied automatically throughout the tax year. Each time something changes, your software will be updated.

• You also benefit from a one-step backup and restore feature that prompts users to backup information each time the software is closed. This helps to ensure that you do not ever need to worry about valuable information being lost.

Do you operate a small or large accounting practice? Because of the robust list of features available, Payroll Mate® can make it easier for you to provide your clients with the superior accounting services they deserve while operating your accounting practice in a more efficient and streamlined manner.

These are only some of the features of Payroll Mate. Please refer to the Payroll Mate payroll software page for more details.