Insurance Agency Payroll Software

Payroll Mate® makes processing payroll easy and affordable.

Our payroll system offers many features that can cater to the special payroll processing needs of an insurance agency. Do you offer your insurance agency employees with special bonuses based on their sales? If so, you can custom create unlimited income categories to ensure your employees are always paid based on their sales. Pay service representatives, account managers, agents, underwriters, sales team, customer service reps and other agency employees.

For $219 only, process payroll for up to 10 agencies with up to 75 employees per agency for one calendar year.

Insurance Agency Payroll Made Easy

Considering all the many and ever-increasing regulations associated with the insurance industry, operating an insurance company can be challenging. The last thing you need is to face more challenges because you have an ineffective system in place for handling payroll administration. Adding a payroll software solution such as Payroll Mate® can help you to set aside such worries while ensuring that payroll is always handled accurately and timely.

Paying Your Insurance Agency Employees

• Payroll Mate® makes it easier to ensure that your payroll is accurate while also meeting all required federal and state regulations.

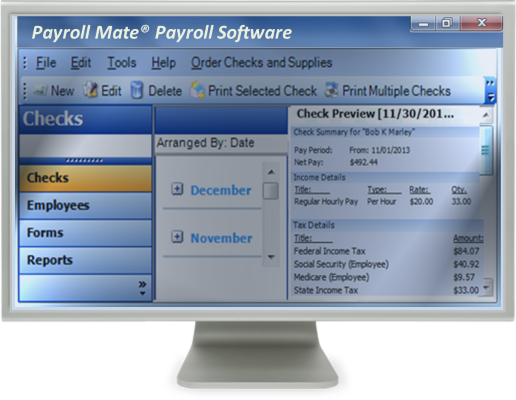

- Net pay, State and Federal Withholdings, Social Security, and Medicare amounts are automatically calculated for you.

- Multiple pay frequencies are supported. These include: daily, weekly, bi-weekly, semi-monthly, and monthly.

- Multiple pay types are supported including hourly, salary, commission, bonuses, and many more.

- Payroll Mate® is highly customizable with the option to custom create unlimited tax, deduction, and income categories. This ensures you can handle any sort of payroll situation.

• Signature ready checks are easily printed with a few easy steps. Pay stubs can also be printed or emailed to your clients or employees for easy to access payroll data.

• Since Payroll Mate® is designed to support federal annual and quarterly payroll forms including W-2, W-3, 940, 941, 943, and 944, you never have to worry about whether you are in compliance. Payroll Mate® will produce everything so that it is ready to sign and send. Simple!

• Do you need to process payroll for vendors or independent contractors? With an additional cost add-on feature to Payroll Mate® you can create vendor checks, print reports, and access 1099-MISC and 1096 forms at the end of the year. This feature can also create non payroll checks for items such as rent payments, utility bills, and more.

• Payroll Mate® also ensures that you do not have to worry about manually trying to track vacation and sick time accrual. Payroll Mate® can do all the hard work for you by tracking and accruing two different types of leave hours, both vacation and sick leave.

• Are you required to submit state payroll forms? If so, this can be supported with an additional cost add-on feature. The state forms that are supported with this feature are:

- Illinois Unemployment Insurance and Illinois Withholding Income Tax

- Texas Unemployment Insurance

- NYS-45 (New York Withholding Tax and Unemployment Insurance)

- California DE 9 (Quarterly Contribution Return and Report of Wages)

- California DE 9C (Annual Contribution Return and Report of Wages)

- Florida RT-6 (Florida Reemployment Tax)

- If your state is not listed, simply pull a State Taxes report which provides you with your figures so you can manually fill out your state forms

Payroll Reports

• When you need to gain increased insight into what is going on with your payroll, there is no need to spend an excessive amount of time in combing through files and records. Payroll Mate® offers a variety of reports, including Payroll Journal Detail, Payroll Totals, Employee List, Employee Earnings, Deposit Requirement, Taxes & Deductions, and many more.

• Payroll reports can also be easily and quickly sent via email using this solution, thus helping to save you a tremendous amount of time and hassle. That is time that you can deploy to other areas of your business to help grow it while also providing your clients with superior service.

• From time to time, you may need to make notes about employees to assist you with payroll, such as whether a particular agent has a certain commission coming at the next pay period. The process is simplified with the ability to add employee notes in Payroll Mate®.

Keeping Employee Info Accessible and Secure

• In operating an insurance company, you understand how important it is that you maintain records. If anything should happen to your payroll records, it could be devastating. This is something you do not need to worry about with Payroll Mate® because you will receive an automatic notification to remind you to back-up your payroll so it can be easily restored.

• Since payroll information typically contains a tremendous amount of personal and confidential information, it is vital to ensure that it is kept as secure as possible. Payroll Mate® can help you to keep such data completely confidential by providing password protection. With this feature, users will need to key in a password to access the system.

• Additionally, you can opt to hide or mask social security numbers on pay stubs for even greater confidentiality and security.

With all of the responsibilities associated with your insurance agency, why not look to a solution that can make processing payroll easier and more time efficient? Payroll Mate® can do this for you so you can ensure your business practices are still kept up with.

These are only some of the features of Payroll Mate. Please refer to the Payroll Mate payroll software page for more details.